Dow Jones Industrial Average Index Key Data

The Dow Jones Industrial Average (DJIA), often referred to as the Dow, is one of the most widely recognized stock market indices in the world. It is composed of 30 large publicly traded companies based in the United States. The DJIA is used as a gauge to measure the performance of the overall stock market and provide insights into the health of the economy.

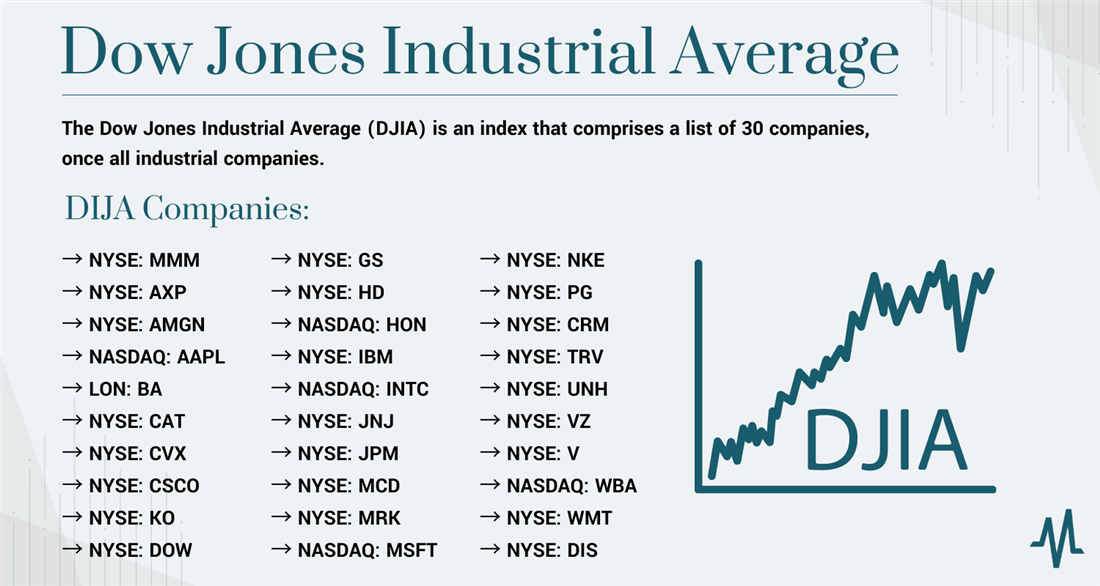

Components of the Dow Jones Industrial Average

The Dow Jones Industrial Average includes companies from various sectors such as technology, finance, healthcare, energy, and consumer goods. Some of the current components of the index include:

- Apple Inc. (AAPL)

- The Boeing Company (BA)

- Cisco Systems, Inc. (CSCO)

- The Coca-Cola Company (KO)

- Goldman Sachs Group, Inc. (GS)

- Intel Corporation (INTC)

- Johnson & Johnson (JNJ)

- McDonald’s Corporation (MCD)

- Microsoft Corporation (MSFT)

- Nike, Inc. (NKE)

- Visa Inc. (V)

Calculation Methodology

The DJIA is calculated using a price-weighted methodology. This means that higher-priced stocks have a greater influence on the index’s movements. To calculate the index value, the sum of the prices of all 30 component stocks is divided by a divisor, which is adjusted periodically to account for stock splits, dividends, and other corporate actions.

Key Data Points

Here are some key data points that investors and market participants often consider when analyzing the Dow Jones Industrial Average:

- Opening Price: The price of the index at the beginning of a trading session.

- Closing Price: The price of the index at the end of a trading session.

- Previous Close: The closing price of the index in the previous trading session.

- High: The highest price reached by the index during a trading session.

- Low: The lowest price reached by the index during a trading session.

- Percentage Change: The percentage difference between the current price and the previous day’s closing price.

- Market Capitalization: The total market value of all 30 companies in the index combined.

These key data points provide valuable insights into the performance and trends of the stock market. They help investors make informed decisions about their portfolios and assess the overall sentiment of the market.

Usage and Significance

The Dow Jones Industrial Average is frequently used as a benchmark for the broader stock market. Financial news outlets report the daily movements of the index, and it is often seen as an indicator of the market’s health and investor sentiment. Traders and investors closely monitor the Dow to identify trends, patterns, and potential trading opportunities.

Moreover, the DJIA serves as the basis for various financial instruments such as futures contracts, options, and exchange-traded funds (ETFs). These instruments allow investors to speculate on or gain exposure to the performance of the index without directly owning the underlying stocks.

Conclusion

The Dow Jones Industrial Average is a crucial stock market index that provides insights into the overall health of the economy and investor sentiment. With its diverse components and price-weighted calculation methodology, the DJIA offers valuable data points for investors to analyze and make informed decisions. Whether you are a seasoned trader or a novice investor, keeping an eye on the Dow can help you stay updated with the latest market trends and developments.