Market Sentiments

-

COUNTRIES:

-

PAIRS THAT CORRELATE:

-

2022 HIGHS & LOWS:

-

PAIR TYPE:

-

DAILY AVERAGE MOVEMENT IN PIPS:

ONE-YEAR CHART:

EUR ADDITIONAL INFO

-

COUNTRY:

-

CENTRAL BANK:

-

NICKNAME:

-

%OF AVERAGE DAILY TURNOVER:

USDADDITIONAL INFO

-

COUNTRY:

-

CENTRAL BANK:

-

NICKNAME:

-

%OF AVERAGE DAILY TURNOVER:

Natural Gas: A Key Energy Resource

Natural gas is a crucial source of energy that plays a significant role in powering industries, households, and transportation systems worldwide. It is widely used for heating, cooking, generating electricity, and as a fuel for vehicles, making it a versatile and valuable resource.

XNGUSD – Analyzing the Spot Price

One important aspect of natural gas is its spot price, which refers to the current market value of the commodity for immediate delivery. The XNGUSD (US Natural Gas – Spot) ticker symbol represents the spot price of natural gas traded on certain commodity exchanges. Understanding this spot price is vital for investors, traders, and analysts who closely monitor the natural gas market.

Factors Influencing Natural Gas Prices

Several factors impact the spot price of natural gas, causing fluctuations in its value. Here are some key elements that influence the price:

- Supply and Demand: Like any other commodity, the balance between supply and demand significantly affects natural gas prices. If demand exceeds supply, prices tend to rise, whereas oversupply can lead to a decline.

- Weather Conditions: Natural gas demand is highly weather-dependent. Cold winters and hot summers increase the need for heating and cooling, respectively, boosting consumption and driving prices up.

- Storage Levels: The amount of natural gas stored in underground facilities also impacts prices. Lower storage levels often result in higher prices due to concerns over supply shortages.

- Geopolitical Factors: Political tensions, production disruptions, or changes in import/export policies can all cause fluctuations in natural gas prices.

The Future of Natural Gas

Natural gas continues to play a significant role in the global energy landscape, particularly as countries strive to reduce their carbon emissions and transition towards cleaner fuels. Its relatively lower carbon footprint compared to other fossil fuels, such as coal and oil, makes it an attractive option.

However, the future of natural gas also faces challenges related to environmental concerns and the increasing adoption of renewable energy sources. As the world shifts towards sustainable alternatives, natural gas must be utilized strategically and in conjunction with cleaner technologies to minimize its impact on climate change.

In Conclusion

Natural gas is a versatile and vital energy resource, powering various sectors worldwide. The XNGUSD spot price provides valuable insights into the current market value of natural gas, allowing investors and analysts to make informed decisions.

As we navigate the path towards a more sustainable energy future, it is crucial to leverage natural gas responsibly and explore greener alternatives. By embracing innovative technologies and maintaining a balance between supply and demand, we can ensure that natural gas continues to contribute to our energy needs while minimizing its environmental impact.

As the world’s third-largest energy source, natural gas plays a crucial role in meeting global energy demands. Natural gas futures are traded on various exchanges, including the XNGUSD, which provides investors with an opportunity to profit from price fluctuations in this commodity. This article aims to provide you with the latest news and market movers impacting the Natural Gas-XNGUSD market.

1. Supply and Demand Dynamics

The fundamental factors of supply and demand significantly impact the Natural Gas-XNGUSD market. Changes in production, storage levels, weather patterns, and consumption trends can have a direct influence on natural gas prices. Stay abreast of updates related to these factors as they can dictate market sentiment and price movements.

2. Weather Forecast

Weather plays a pivotal role in natural gas demand. Cold winters and hot summers increase the need for heating and cooling, respectively, leading to higher natural gas consumption. Monitoring weather forecasts, especially during extreme weather events, can give you insights into potential spikes or declines in natural gas prices.

3. Inventory Reports

Weekly inventory reports released by organizations like the Energy Information Administration (EIA) provide crucial data on natural gas stockpiles. Inventory levels above or below market expectations can influence price movements. Lower-than-anticipated inventories may push prices higher due to concerns about supply shortages, while higher inventories could lead to price drops.

4. Geopolitical Factors

Geopolitical events and developments in key natural gas-producing regions can impact prices. Conflicts, political instability, changes in regulations, and pipeline disruptions can cause supply disruptions or affect market sentiments. Stay informed about any geopolitical news that could potentially influence the Natural Gas-XNGUSD market.

5. Economic Indicators

Economic indicators, such as GDP growth, industrial production, and employment data, can provide insights into natural gas demand. Strong economic growth often correlates with increased energy consumption, including natural gas. Monitoring these indicators can help you gauge the potential market movements.

6. Technological Advancements

Technological advancements in the extraction and production of natural gas, such as fracking and liquefied natural gas (LNG) technologies, can impact supply dynamics and prices. Keeping an eye on innovations and developments in the natural gas industry can help you identify potential opportunities or risks.

7. Environmental Factors

The growing focus on renewable energy sources and the impact of natural gas on climate change policies can influence market sentiments. Government regulations aimed at reducing carbon emissions and promoting clean energy alternatives may affect natural gas demand and prices. Stay informed about any regulatory changes and their potential impact on the market.

By staying updated on these news and market movers, you can make more informed decisions when trading Natural Gas-XNGUSD futures. Remember to conduct thorough research, analyze multiple factors, and consider risk management strategies before making any investment decisions.

Comodities

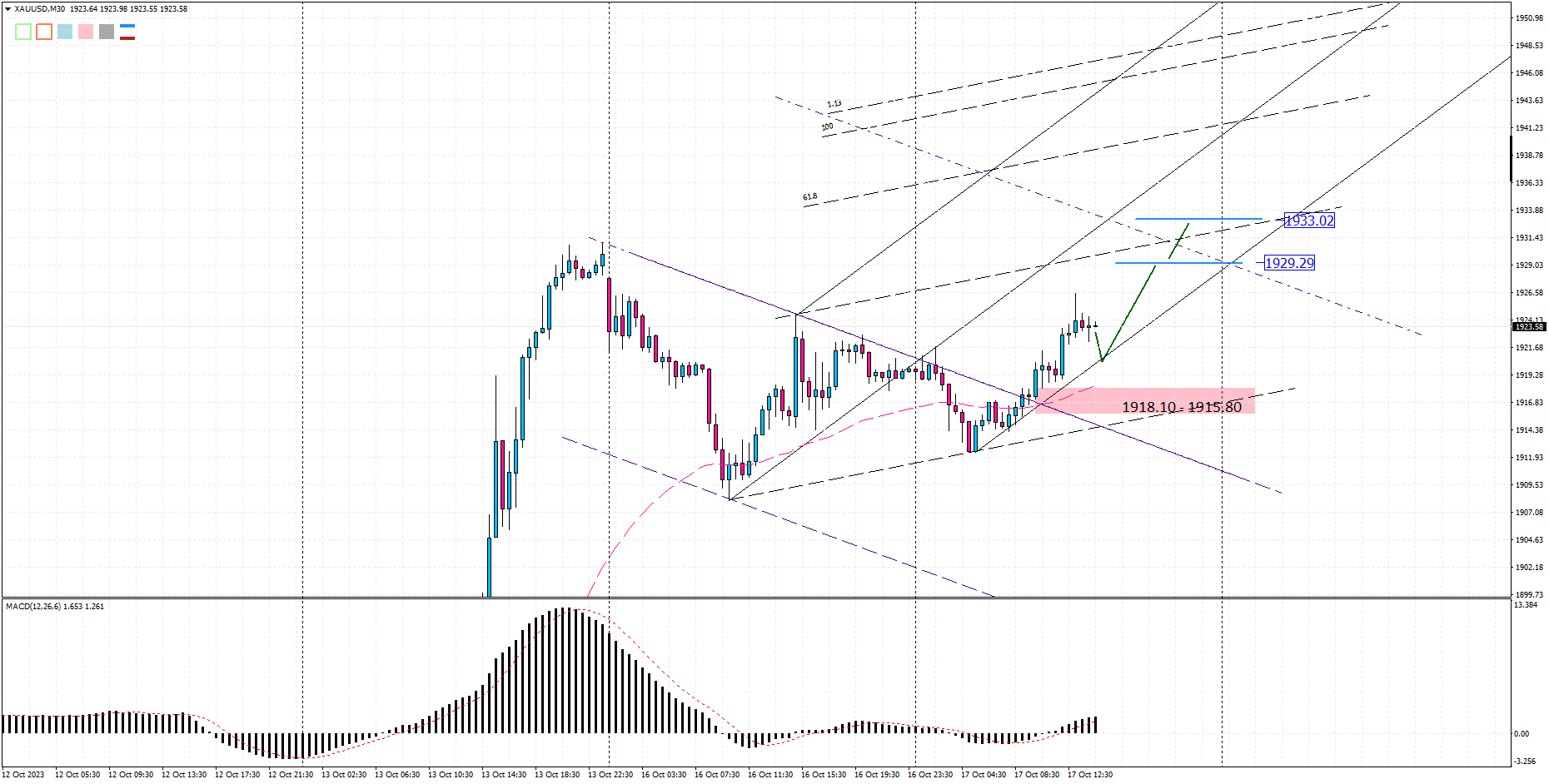

- XAUUSD-Gold Spot / U.S. Dollar

- Natural gas-XNGUSD

- WTI Crude Oil-US Cruide Oil-West Texas Intermediate Crude Oil or US Crude Oil

- XAGUSD--Silver / U.S. Dollar

- Brent Crude Oil-Brent_G3

- Crude Oil-XTIUSD

- XBRUSD-Brent Oil

- XBRUSD-Brent Oil vs US Dollar

- Adzuki bean

- CAC All-Tradable

- Cobalt

- Cocoa

- Coffee C

- Corn

- Corn (EURONEXT)

- Corn(DCE)

- Cotton No.2

- Crack Spread

- Crush Spread

- Feeder Cattle

- Frozen Concentrated Orange Juice

- Hardwood Pulp

- Heating Oil

- Lead

- Lean Hogs

- Live Cattle

- LME Copper

- LME Nickel

- Methods

- Milk

- Molybdenum

- Natural gas-XNGUSD

- Oats

- Palm Oil

- Petrocurrency

- Propane

- Purified Terephthalic Acid (PTA)

- Random Length Lumber

- Rapeseed

- Rough Rice

- Rubber

- Softwood Pulp

- Soy Meal

- Soybean (DCE)

- Soybean Meal

- Soybean Oil

- Soybean Oil (DCE)

- Soybeans

- Sugar No.11

- Sugar No.14

- Tin

- West Texas Intermediate WTI

- Wheat (CBOT)

- Wheat (EURONEXT)

- XAGAUD-Silver vs Australian Dollar

- XAGEUR-Silver Vs Euro

- XAGGBP-Silver vs Great Britain Pound

- XAUAUD-Gold vs Australian Dollar

- XAUCHF-Gold Vs Swiss Franc

- XAUEUR-Gold Vs Euro

- XAUGBP-Gold vs Great Britain Pound

- XAUJPY-Gold vs Japanese Yen

- XNGUSD-Natural Gas vs US Dollar

- XPDUSD-Palladium Vs US Dollar

- XPTUSD-Platinum vs US Dollar

- Zinc

Fundamental Summary

NATGAS

0.00000

Strength

NATGAS

0.00000

Strength

NATGAS

0.00000

Strength

NATGAS

0.00000

Strength

NATGAS

0.00000

Strength

NATGAS

0.00000

Strength

NATGAS

0.00000

Strength

-

NATGAS

Minute5

short

shortResistance5 3489.25000 Resistance4 3482.25000 Resistance3 3473.75000 Resistance2 3452.25000 Resistance1 3380.75000 Quote Price 0.00000 Support1 3364.75000 Next Trade2023-10-16 00:27:32 -

NATGAS

Minute15

long

longResistance4 3583.75000 Resistance3 3473.75000 Resistance2 3452.25000 Resistance1 3380.75000 Quote Price 0.00000 Support1 3364.75000 Support2 3284.75000 Next Trade2023-10-16 00:27:35 -

NATGAS

Minute30

short

shortResistance2 3583.75000 Resistance1 3555.75000 Quote Price 0.00000 Support1 3458.75000 Support2 3438.25000 Support3 3064.75000 Support4 3045.75000 Next Trade2023-10-16 00:27:37 -

NATGAS

Hour1

short

shortResistance1 3583.75000 Quote Price 0.00000 Support1 3438.25000 Support2 3064.75000 Support3 2902.75000 Support4 2886.75000 Support5 2788.75000 Next Trade2023-10-16 00:27:39 -

NATGAS

Hour4

long

longResistance5 2245.75000 Resistance4 2477.75000 Resistance3 2513.25000 Resistance2 2625.75000 Resistance1 2788.75000 Quote Price 0.00000 Support1 3583.75000 Next Trade2023-10-16 00:27:39 -

NATGAS

Daily

short

shortResistance4 2061.75000 Resistance3 2091.75000 Resistance2 2156.75000 Resistance1 2477.75000 Quote Price 0.00000 Support1 3583.75000 Support2 8091.75000 Next Trade2023-10-16 00:27:42 -

NATGAS

Weekly

short

shortResistance2 2061.75000 Resistance1 2061.75000 Quote Price 0.00000 Support1 3583.75000 Support2 9972.75000 Support3 3583.75000 Support4 9972.75000 Next Trade2023-10-28 10:30:16 -

NATGAS

Monthly

Resistance1 9972.75000 Quote Price Support1 2061.75000 Next Trade2023-10-28 10:30:21

- Coming soon!!

Technical Summary

NATGAS

0.00000

Strength

NATGAS

0.00000

Strength

NATGAS

0.00000

Strength

NATGAS

0.00000

Strength

NATGAS

0.00000

Strength

NATGAS

0.00000

Strength

NATGAS

0.00000

Strength

-

NATGAS

Minute5

short

shortResistance5 3489.25000 Resistance4 3482.25000 Resistance3 3473.75000 Resistance2 3452.25000 Resistance1 3380.75000 Quote Price 0.00000 Support1 3364.75000 Next Trade2023-10-16 00:27:32 -

NATGAS

Minute15

long

longResistance4 3583.75000 Resistance3 3473.75000 Resistance2 3452.25000 Resistance1 3380.75000 Quote Price 0.00000 Support1 3364.75000 Support2 3284.75000 Next Trade2023-10-16 00:27:35 -

NATGAS

Minute30

short

shortResistance2 3583.75000 Resistance1 3555.75000 Quote Price 0.00000 Support1 3458.75000 Support2 3438.25000 Support3 3064.75000 Support4 3045.75000 Next Trade2023-10-16 00:27:37 -

NATGAS

Hour1

short

shortResistance1 3583.75000 Quote Price 0.00000 Support1 3438.25000 Support2 3064.75000 Support3 2902.75000 Support4 2886.75000 Support5 2788.75000 Next Trade2023-10-16 00:27:39 -

NATGAS

Hour4

long

longResistance5 2245.75000 Resistance4 2477.75000 Resistance3 2513.25000 Resistance2 2625.75000 Resistance1 2788.75000 Quote Price 0.00000 Support1 3583.75000 Next Trade2023-10-16 00:27:39 -

NATGAS

Daily

short

shortResistance4 2061.75000 Resistance3 2091.75000 Resistance2 2156.75000 Resistance1 2477.75000 Quote Price 0.00000 Support1 3583.75000 Support2 8091.75000 Next Trade2023-10-16 00:27:42 -

NATGAS

Weekly

short

shortResistance2 2061.75000 Resistance1 2061.75000 Quote Price 0.00000 Support1 3583.75000 Support2 9972.75000 Support3 3583.75000 Support4 9972.75000 Next Trade2023-10-28 10:30:16 -

NATGAS

Monthly

Resistance1 9972.75000 Quote Price Support1 2061.75000 Next Trade2023-10-28 10:30:21