Market Sentiments

-

COUNTRIES:

-

PAIRS THAT CORRELATE:

-

2022 HIGHS & LOWS:

-

PAIR TYPE:

-

DAILY AVERAGE MOVEMENT IN PIPS:

ONE-YEAR CHART:

EUR ADDITIONAL INFO

-

COUNTRY:

-

CENTRAL BANK:

-

NICKNAME:

-

%OF AVERAGE DAILY TURNOVER:

USDADDITIONAL INFO

-

COUNTRY:

-

CENTRAL BANK:

-

NICKNAME:

-

%OF AVERAGE DAILY TURNOVER:

WTI Crude Oil, also known as West Texas Intermediate Crude Oil, is a type of crude oil that serves as a benchmark for oil pricing in the United States. It is one of the most actively traded commodities in the world and plays a crucial role in the global energy market.

Key Data

Here are some important key data points related to WTI Crude Oil and US Crude Oil:

- Price: The price of WTI Crude Oil is used as a reference point for oil trading. It is quoted in US dollars per barrel and fluctuates based on supply and demand dynamics, geopolitical events, economic factors, and market sentiment.

- Production: The United States is one of the largest producers of crude oil globally. It has experienced significant growth in production due to technological advancements in shale oil extraction, making it less dependent on imports.

- Consumption: The US is also one of the largest consumers of crude oil, driven by its industrial, transportation, and residential sectors. Changes in consumption patterns can have a direct impact on global oil prices.

- Inventories: Weekly inventory reports provide insights into the stockpile levels of crude oil in the US. High inventories may indicate oversupply and put downward pressure on oil prices, while low inventories may lead to price increases.

- Oil Rig Count: The number of active oil rigs in the US, as reported by oilfield services companies like Baker Hughes, is an important indicator of future production levels. A higher rig count suggests increased drilling activity and potentially higher oil output.

- Exports and Imports: The US exports and imports crude oil to meet its energy demands. Changes in export or import policies, geopolitical tensions, or disruptions to supply routes can impact global oil flows and prices.

Understanding these key data points and keeping track of their changes is crucial for investors, traders, and policymakers involved in the oil market. WTI Crude Oil and US Crude Oil serve as vital indicators of global energy trends and can have significant implications for the overall economy.

WTI Crude Oil, also known as West Texas Intermediate Crude Oil or US Crude Oil, is one of the most widely traded and benchmarked commodities in the world. It serves as a crucial indicator of global economic health and influences various sectors such as energy, transportation, and finance.

What is WTI Crude Oil?

WTI Crude Oil refers to a type of crude oil that is extracted from the Permian Basin in West Texas. It is known for its relatively high quality and low sulfur content, making it a desirable form of oil for refining into gasoline and other petroleum products. WTI Crude Oil is primarily traded on the New York Mercantile Exchange (NYMEX) under the ticker symbol “CL.”

Benchmark Status

WTI Crude Oil holds benchmark status within the oil industry. The prices of other crude oils worldwide are often quoted with reference to the price of WTI Crude Oil. This benchmark status is due to multiple factors, including its high liquidity, consistent quality, and the presence of a robust futures market.

Factors Influencing WTI Crude Oil Prices

Several factors impact the price of WTI Crude Oil:

- Supply and demand dynamics: Changes in production levels, geopolitical tensions, and global economic growth significantly affect WTI Crude Oil prices.

- Global events: Geopolitical events, conflicts, and natural disasters can disrupt oil supply or lead to increased demand, resulting in price fluctuations.

- OPEC decisions: As a significant player in the oil market, decisions made by the Organization of the Petroleum Exporting Countries (OPEC) can have a substantial impact on WTI Crude Oil prices.

- US Dollar strength: As WTI Crude Oil is priced in US dollars, fluctuations in the value of the currency can influence its price.

Importance in the Energy Sector

The energy sector relies heavily on WTI Crude Oil prices. It affects gasoline and diesel prices, which, in turn, impact transportation costs for businesses and consumers. The profitability of oil exploration and production companies is also influenced by WTI Crude Oil prices. Additionally, trends in WTI Crude Oil prices often indicate the overall health of the global economy.

Investing in WTI Crude Oil

Investors who wish to gain exposure to WTI Crude Oil can do so through various financial instruments such as futures contracts, exchange-traded funds (ETFs), or even direct investment in oil-producing companies. However, it’s important to note that investing in commodities involves risks, including volatility and market uncertainty.

Conclusion

WTI Crude Oil plays a pivotal role in the global economy, serving as a benchmark for oil prices worldwide. Its supply and demand dynamics are influenced by multiple factors, making it an essential commodity to monitor for governments, businesses, and investors alike. Understanding WTI Crude Oil helps in gaining insights into the energy sector, economic trends, and global financial markets.

Comodities

- XAUUSD-Gold Spot / U.S. Dollar

- Natural gas-XNGUSD

- WTI Crude Oil-US Cruide Oil-West Texas Intermediate Crude Oil or US Crude Oil

- XAGUSD--Silver / U.S. Dollar

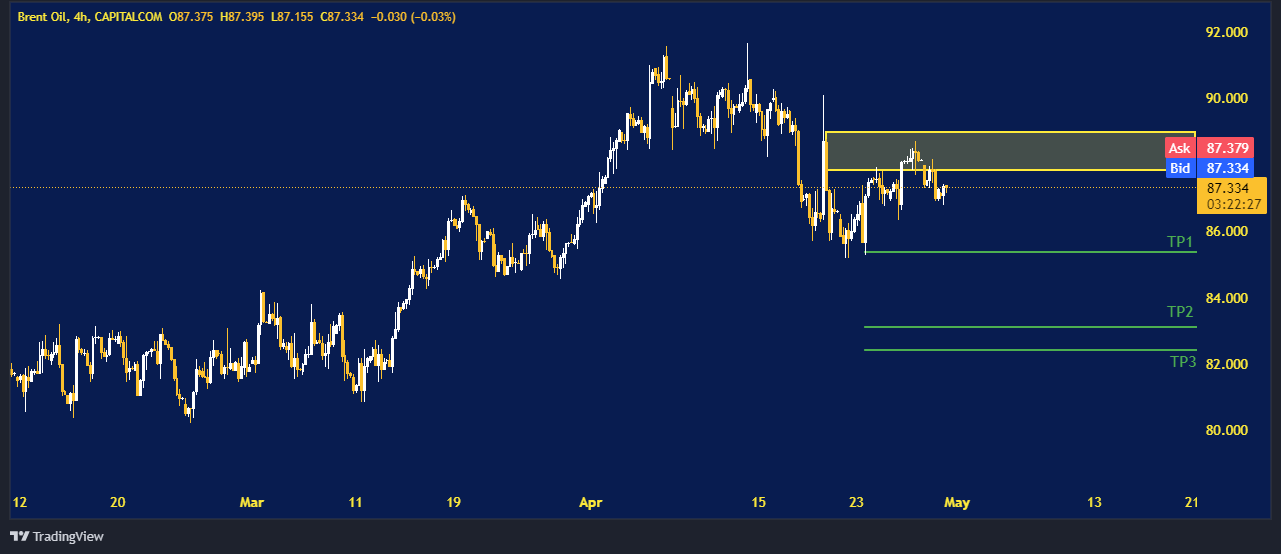

- Brent Crude Oil-Brent_G3

- Crude Oil-XTIUSD

- XBRUSD-Brent Oil

- XBRUSD-Brent Oil vs US Dollar

- Adzuki bean

- CAC All-Tradable

- Cobalt

- Cocoa

- Coffee C

- Corn

- Corn (EURONEXT)

- Corn(DCE)

- Cotton No.2

- Crack Spread

- Crush Spread

- Feeder Cattle

- Frozen Concentrated Orange Juice

- Hardwood Pulp

- Heating Oil

- Lead

- Lean Hogs

- Live Cattle

- LME Copper

- LME Nickel

- Methods

- Milk

- Molybdenum

- Natural gas-XNGUSD

- Oats

- Palm Oil

- Petrocurrency

- Propane

- Purified Terephthalic Acid (PTA)

- Random Length Lumber

- Rapeseed

- Rough Rice

- Rubber

- Softwood Pulp

- Soy Meal

- Soybean (DCE)

- Soybean Meal

- Soybean Oil

- Soybean Oil (DCE)

- Soybeans

- Sugar No.11

- Sugar No.14

- Tin

- West Texas Intermediate WTI

- Wheat (CBOT)

- Wheat (EURONEXT)

- XAGAUD-Silver vs Australian Dollar

- XAGEUR-Silver Vs Euro

- XAGGBP-Silver vs Great Britain Pound

- XAUAUD-Gold vs Australian Dollar

- XAUCHF-Gold Vs Swiss Franc

- XAUEUR-Gold Vs Euro

- XAUGBP-Gold vs Great Britain Pound

- XAUJPY-Gold vs Japanese Yen

- XNGUSD-Natural Gas vs US Dollar

- XPDUSD-Palladium Vs US Dollar

- XPTUSD-Platinum vs US Dollar

- Zinc

Fundamental Summary

WTIUSD

0.00000

Strength

WTIUSD

0.00000

Strength

WTIUSD

0.00000

Strength

WTIUSD

0.00000

Strength

WTIUSD

0.00000

Strength

WTIUSD

0.00000

Strength

WTIUSD

0.00000

Strength

WTIUSD

0.00000

Strength

-

WTIUSD

Minute5

short

shortResistance5 85.53600 Resistance4 84.96500 Resistance3 84.62700 Resistance2 84.43600 Resistance1 83.06700 Quote Price 0.00000 Support1 80.50000 Next Trade2023-10-31 16:00:50 -

WTIUSD

Minute15

short

shortResistance5 87.97800 Resistance4 86.01400 Resistance3 85.53600 Resistance2 84.43600 Resistance1 83.06700 Quote Price 0.00000 Support1 80.50000 Next Trade2023-10-31 16:00:17 -

WTIUSD

Minute30

short

shortResistance5 87.97800 Resistance4 86.01600 Resistance3 85.53600 Resistance2 84.43600 Resistance1 83.06700 Quote Price 0.00000 Support1 80.50000 Next Trade2023-10-31 16:00:51 -

WTIUSD

Hour1

short

shortResistance5 92.10000 Resistance4 90.87000 Resistance3 89.60800 Resistance2 85.53600 Resistance1 83.06700 Quote Price 0.00000 Support1 80.50000 Next Trade2023-10-31 16:00:53 -

WTIUSD

Hour4

short

shortResistance3 93.96300 Resistance2 89.60800 Resistance1 85.53600 Quote Price 0.00000 Support1 80.50000 Support2 77.51500 Support3 74.48200 Next Trade2023-10-31 16:00:56 -

WTIUSD

Daily

long

longResistance3 97.24500 Resistance2 93.96300 Resistance1 89.60800 Quote Price 0.00000 Support1 80.50000 Support2 77.51500 Support3 66.93800 Next Trade2023-10-31 16:00:58 -

WTIUSD

Weekly

long

longResistance4 7.89000 Resistance3 33.81600 Resistance2 61.71700 Resistance1 62.31300 Quote Price 0.00000 Support1 93.96300 Support2 126.37000 Next Trade2023-10-29 16:01:29 -

WTIUSD

Monthly

long

longResistance2 7.89000 Resistance1 63.95900 Quote Price 0.00000 Support1 93.96300 Support2 126.37000 Support3 147.27000 Next Trade2023-10-31 16:01:00

- Coming soon!!

Technical Summary

WTIUSD

0.00000

Strength

WTIUSD

0.00000

Strength

WTIUSD

0.00000

Strength

WTIUSD

0.00000

Strength

WTIUSD

0.00000

Strength

WTIUSD

0.00000

Strength

WTIUSD

0.00000

Strength

WTIUSD

0.00000

Strength

-

WTIUSD

Minute5

short

shortResistance5 85.53600 Resistance4 84.96500 Resistance3 84.62700 Resistance2 84.43600 Resistance1 83.06700 Quote Price 0.00000 Support1 80.50000 Next Trade2023-10-31 16:00:50 -

WTIUSD

Minute15

short

shortResistance5 87.97800 Resistance4 86.01400 Resistance3 85.53600 Resistance2 84.43600 Resistance1 83.06700 Quote Price 0.00000 Support1 80.50000 Next Trade2023-10-31 16:00:17 -

WTIUSD

Minute30

short

shortResistance5 87.97800 Resistance4 86.01600 Resistance3 85.53600 Resistance2 84.43600 Resistance1 83.06700 Quote Price 0.00000 Support1 80.50000 Next Trade2023-10-31 16:00:51 -

WTIUSD

Hour1

short

shortResistance5 92.10000 Resistance4 90.87000 Resistance3 89.60800 Resistance2 85.53600 Resistance1 83.06700 Quote Price 0.00000 Support1 80.50000 Next Trade2023-10-31 16:00:53 -

WTIUSD

Hour4

short

shortResistance3 93.96300 Resistance2 89.60800 Resistance1 85.53600 Quote Price 0.00000 Support1 80.50000 Support2 77.51500 Support3 74.48200 Next Trade2023-10-31 16:00:56 -

WTIUSD

Daily

long

longResistance3 97.24500 Resistance2 93.96300 Resistance1 89.60800 Quote Price 0.00000 Support1 80.50000 Support2 77.51500 Support3 66.93800 Next Trade2023-10-31 16:00:58 -

WTIUSD

Weekly

long

longResistance4 7.89000 Resistance3 33.81600 Resistance2 61.71700 Resistance1 62.31300 Quote Price 0.00000 Support1 93.96300 Support2 126.37000 Next Trade2023-10-29 16:01:29 -

WTIUSD

Monthly

long

longResistance2 7.89000 Resistance1 63.95900 Quote Price 0.00000 Support1 93.96300 Support2 126.37000 Support3 147.27000 Next Trade2023-10-31 16:01:00