-

COUNTRIES:

-

PAIRS THAT CORRELATE:

-

2022 HIGHS & LOWS:

-

PAIR TYPE:

-

DAILY AVERAGE MOVEMENT IN PIPS:

ONE-YEAR CHART:

Table of Contents:

What is XAGEUR?

XAGEUR is a financial instrument that tracks the price of silver in euros. It is traded on various exchanges and can be bought and sold like any other asset.

Benefits of XAGEUR

Investing in XAGEUR has several benefits, including:

- Diversification: XAGEUR provides exposure to the precious metals market, which can help diversify your portfolio.

- Liquidity: XAGEUR is a liquid asset that can be bought and sold easily.

- No storage costs: Unlike physical silver, there are no storage costs associated with holding XAGEUR.

- Low cost: The cost of investing in XAGEUR is relatively low compared to other precious metals investments.

How to Trade XAGEUR

To trade XAGEUR, you will need to have an account with a broker that offers trading of this financial instrument. Once you have opened an account, you can buy and sell XAGEUR on various exchanges.

Factors Affecting XAGEUR

The price of XAGEUR is affected by several factors, including:

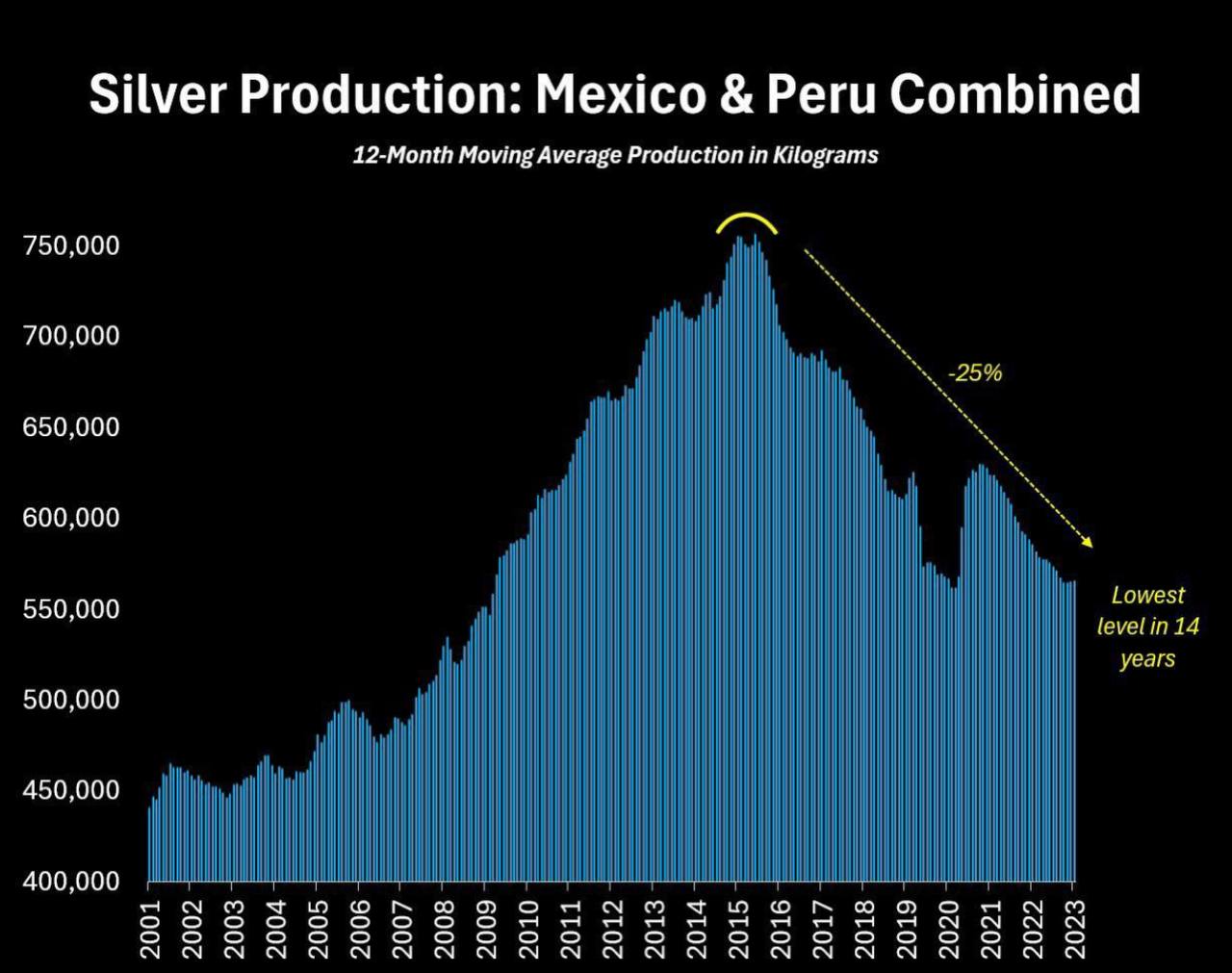

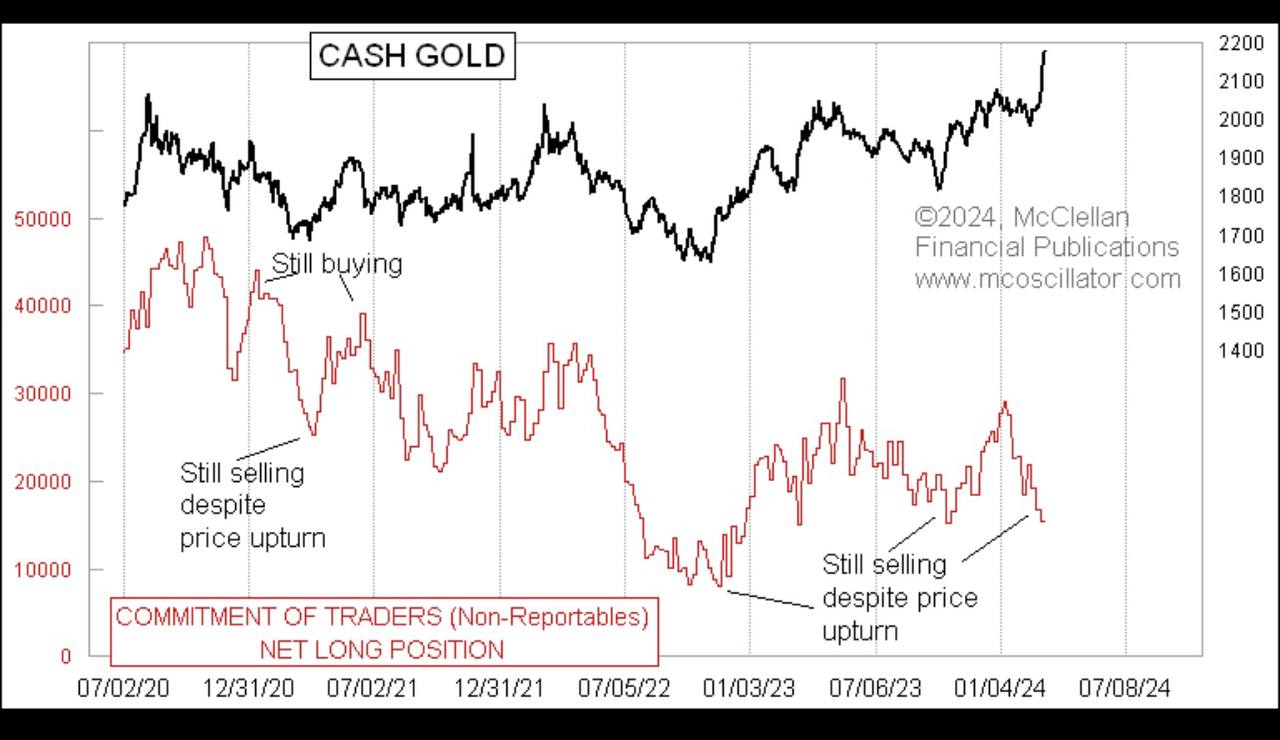

- Demand for silver: The demand for silver affects its price, which in turn affects the price of XAGEUR.

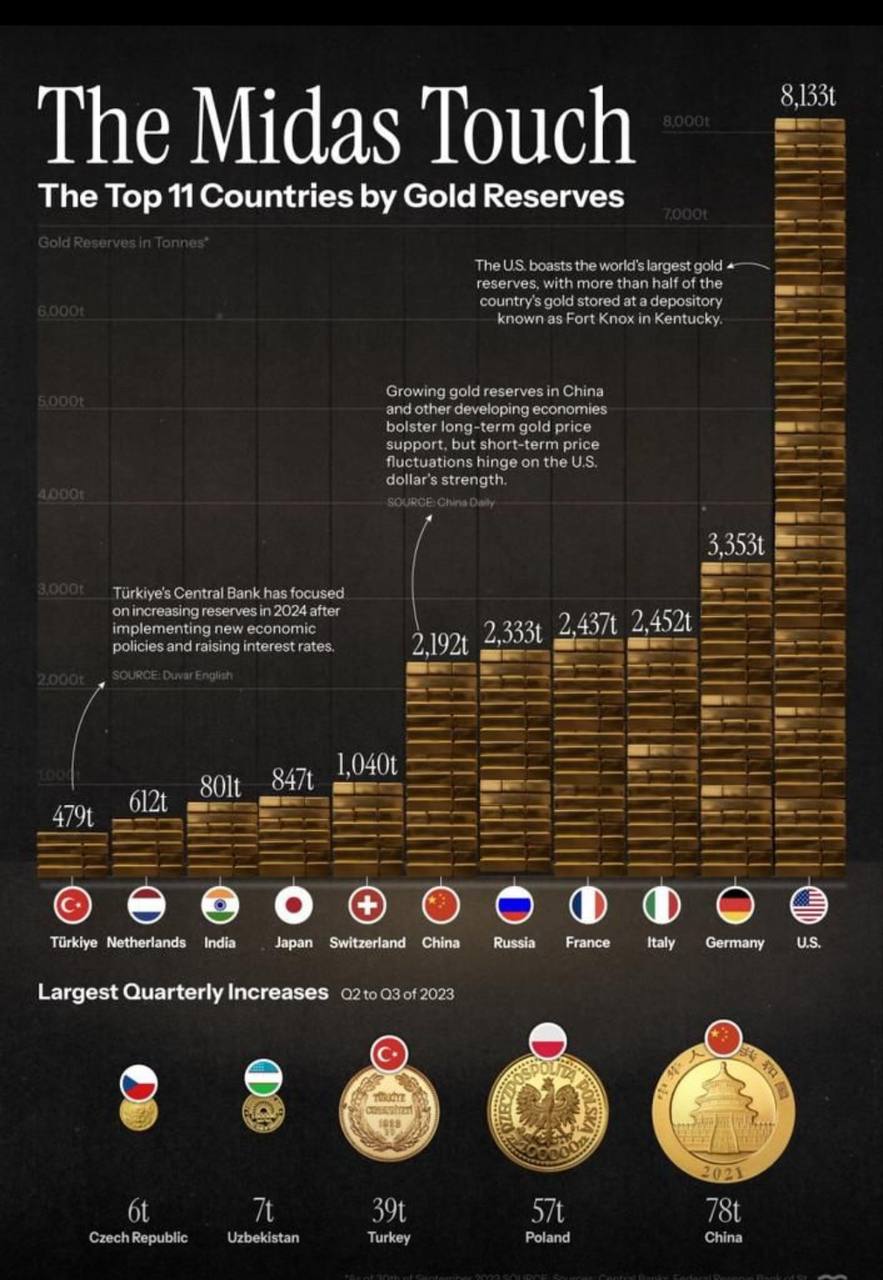

- Economic conditions: Economic conditions, such as inflation or recession, can affect the price of XAGEUR.

- Exchange rates: Since XAGEUR is traded in euros, fluctuations in exchange rates can affect its price.

- Political events: Political events, such as elections or geopolitical tensions, can also affect the price of XAGEUR.

Final Thoughts

XAGEUR is a financial instrument that provides exposure to the precious metals market, specifically silver in euros. Investing in XAGEUR has several benefits, including diversification, liquidity, no storage costs, and low cost. However, the price of XAGEUR is affected by various factors, including demand for silver, economic conditions, exchange rates, and political events.

EUR ADDITIONAL INFO

-

COUNTRY:

-

CENTRAL BANK:

-

NICKNAME:

-

%OF AVERAGE DAILY TURNOVER:

USDADDITIONAL INFO

-

COUNTRY:

-

CENTRAL BANK:

-

NICKNAME:

-

%OF AVERAGE DAILY TURNOVER:

Comodities

- XAUUSD-Gold Spot / U.S. Dollar

- Natural gas-XNGUSD

- WTI Crude Oil-US Cruide Oil-West Texas Intermediate Crude Oil or US Crude Oil

- XAGUSD--Silver / U.S. Dollar

- Brent Crude Oil-Brent_G3

- Crude Oil-XTIUSD

- XBRUSD-Brent Oil

- XBRUSD-Brent Oil vs US Dollar

- Adzuki bean

- CAC All-Tradable

- Cobalt

- Cocoa

- Coffee C

- Corn

- Corn (EURONEXT)

- Corn(DCE)

- Cotton No.2

- Crack Spread

- Crush Spread

- Feeder Cattle

- Frozen Concentrated Orange Juice

- Hardwood Pulp

- Heating Oil

- Lead

- Lean Hogs

- Live Cattle

- LME Copper

- LME Nickel

- Methods

- Milk

- Molybdenum

- Natural gas-XNGUSD

- Oats

- Palm Oil

- Petrocurrency

- Propane

- Purified Terephthalic Acid (PTA)

- Random Length Lumber

- Rapeseed

- Rough Rice

- Rubber

- Softwood Pulp

- Soy Meal

- Soybean (DCE)

- Soybean Meal

- Soybean Oil

- Soybean Oil (DCE)

- Soybeans

- Sugar No.11

- Sugar No.14

- Tin

- West Texas Intermediate WTI

- Wheat (CBOT)

- Wheat (EURONEXT)

- XAGAUD-Silver vs Australian Dollar

- XAGEUR-Silver Vs Euro

- XAGGBP-Silver vs Great Britain Pound

- XAUAUD-Gold vs Australian Dollar

- XAUCHF-Gold Vs Swiss Franc

- XAUEUR-Gold Vs Euro

- XAUGBP-Gold vs Great Britain Pound

- XAUJPY-Gold vs Japanese Yen

- XNGUSD-Natural Gas vs US Dollar

- XPDUSD-Palladium Vs US Dollar

- XPTUSD-Platinum vs US Dollar

- Zinc

Fundamental Summary

- Coming soon!!