-

COUNTRIES:

-

PAIRS THAT CORRELATE:

-

2022 HIGHS & LOWS:

-

PAIR TYPE:

-

DAILY AVERAGE MOVEMENT IN PIPS:

ONE-YEAR CHART:

Table of Content

- Introduction

- What is XAUAUD Gold/AUD?

- Historical Performance

- Factors Affecting Price Movement

- Investing in XAUAUD Gold/AUD

- Conclusion

Introduction

Gold has been considered a popular investment option for many years. It has always been regarded as a safe haven asset and a hedge against inflation. Similarly, the Australian dollar (AUD) has been one of the most traded currencies in the world. Combining these two assets, XAUAUD Gold/AUD has emerged as an attractive investment opportunity. In this article, we will take a closer look at what XAUAUD Gold/AUD is and what factors can impact its price movement.

What is XAUAUD Gold/AUD?

XAUAUD Gold/AUD is a currency pair that represents the value of gold quoted in Australian dollars. It measures the amount of Australian dollars required to purchase one troy ounce of gold. This currency pair is often used by investors who are interested in trading or investing in gold but prefer to use their local currency instead of US dollars.

Historical Performance

The historical performance of XAUAUD Gold/AUD has been impressive. Over the past 10 years, the currency pair has shown consistent growth. In 2010, the price of XAUAUD was around 1,350 AUD per ounce. By 2020, the price had increased to over 2,800 AUD per ounce, representing a growth rate of more than 100%. The steady increase in price can be attributed to the global economic uncertainty and the demand for gold as a safe-haven asset.

Factors Affecting Price Movement

Several factors can impact the price movement of XAUAUD Gold/AUD. Some of these factors include:

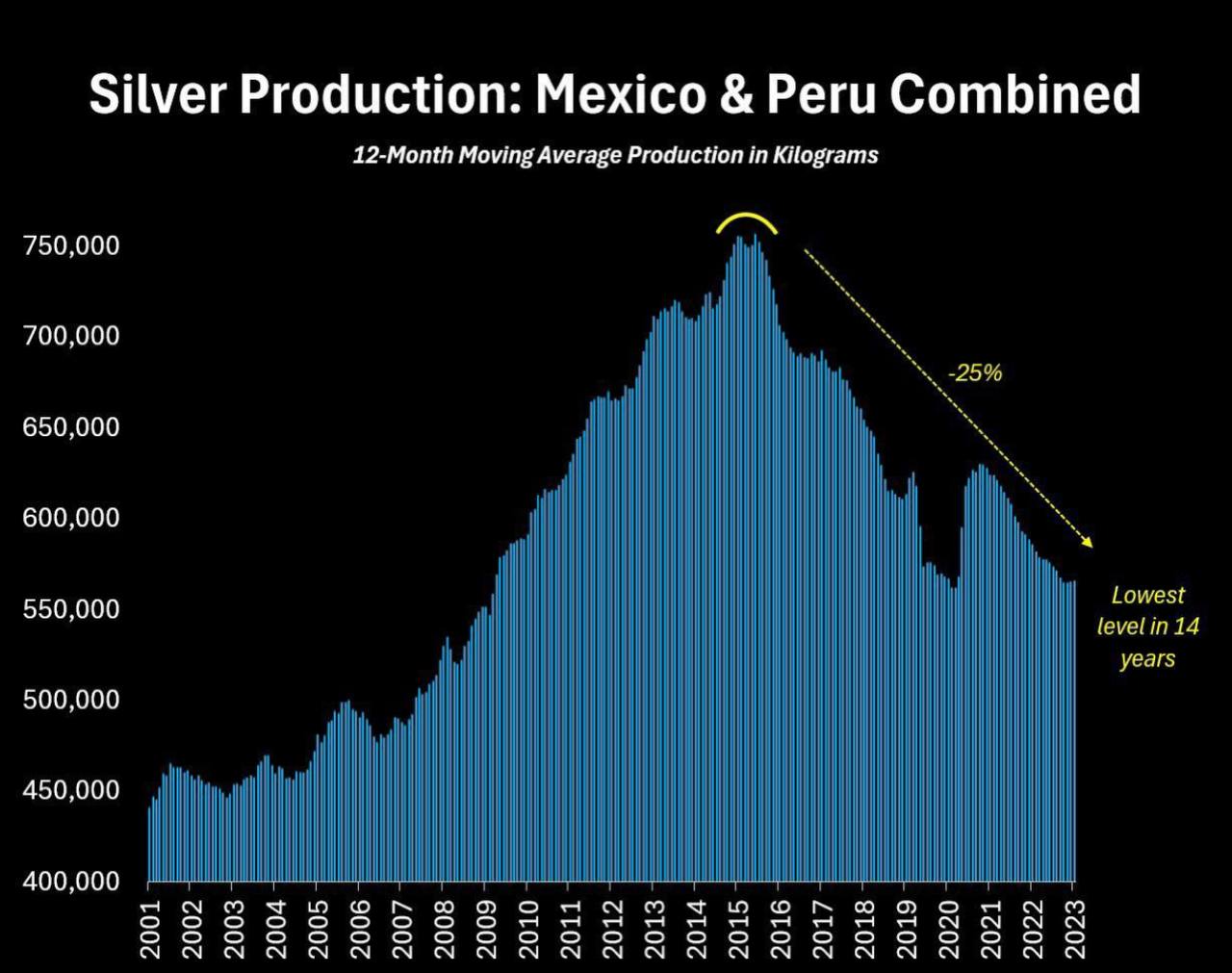

- Demand and Supply: The demand for gold and the supply available in the market can greatly influence the price of XAUAUD. When the demand for gold is high, and supply is limited, the price tends to increase, and vice versa.

- Geo-Political Factors: Geo-political factors such as war, political instability, and economic sanctions can also affect the price of XAUAUD Gold/AUD. These factors can create uncertainty in the market and cause investors to move towards safe-haven assets like gold, which can drive up the price.

- Exchange Rates: The exchange rate between the Australian dollar and other currencies can also impact the price of XAUAUD. If the Australian dollar falls in value against other currencies, the price of XAUAUD will increase, and vice versa.

Investing in XAUAUD Gold/AUD

Investing in XAUAUD Gold/AUD can be done through various means such as:

- Physical gold: Investors can purchase physical gold in the form of bars or coins and keep them in a secure location. This method of investing ensures complete ownership of the asset and eliminates counterparty risk.

- ETFs: Investors can also invest in Exchange Traded Funds (ETFs) that track the price of gold. ETFs are traded on stock exchanges and offer investors an easy way to gain exposure to the gold market.

- Futures and Options: Futures and options contracts allow investors to speculate on the price of XAUAUD Gold/AUD without actually owning the underlying asset. These contracts typically have high leverage, which can magnify profits but also increase losses.

Conclusion

XAUAUD Gold/AUD provides investors with an attractive opportunity to invest in gold using their local currency. The currency pair has shown consistent growth over the past decade, and several factors can impact its price movement. By understanding these factors and choosing the right investment vehicle, investors can take advantage of this opportunity and potentially generate significant returns.

EUR ADDITIONAL INFO

-

COUNTRY:

-

CENTRAL BANK:

-

NICKNAME:

-

%OF AVERAGE DAILY TURNOVER:

USDADDITIONAL INFO

-

COUNTRY:

-

CENTRAL BANK:

-

NICKNAME:

-

%OF AVERAGE DAILY TURNOVER:

Comodities

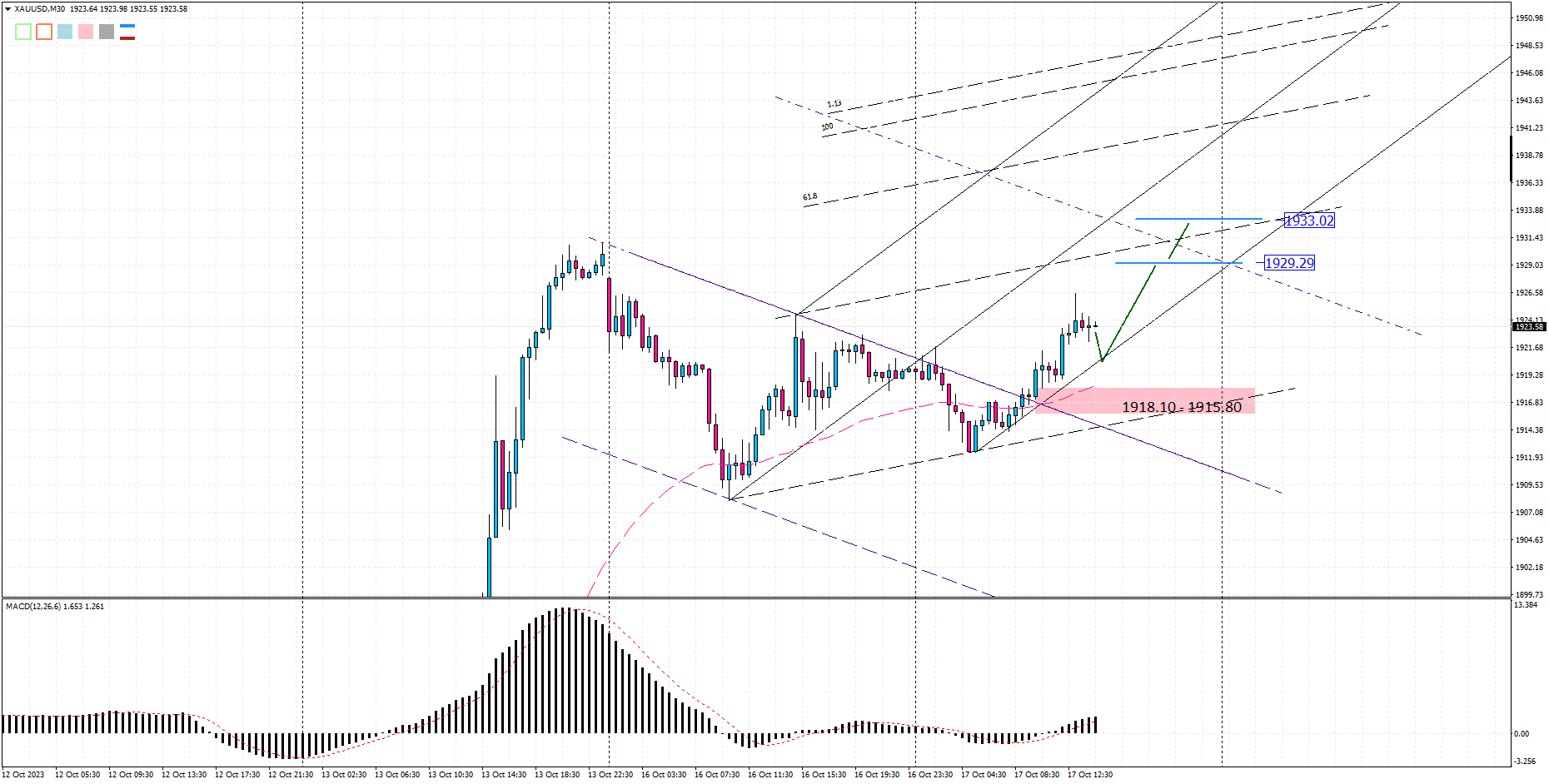

- XAUUSD-Gold Spot / U.S. Dollar

- Natural gas-XNGUSD

- WTI Crude Oil-US Cruide Oil-West Texas Intermediate Crude Oil or US Crude Oil

- XAGUSD--Silver / U.S. Dollar

- Brent Crude Oil-Brent_G3

- Crude Oil-XTIUSD

- XBRUSD-Brent Oil

- XBRUSD-Brent Oil vs US Dollar

- Adzuki bean

- CAC All-Tradable

- Cobalt

- Cocoa

- Coffee C

- Corn

- Corn (EURONEXT)

- Corn(DCE)

- Cotton No.2

- Crack Spread

- Crush Spread

- Feeder Cattle

- Frozen Concentrated Orange Juice

- Hardwood Pulp

- Heating Oil

- Lead

- Lean Hogs

- Live Cattle

- LME Copper

- LME Nickel

- Methods

- Milk

- Molybdenum

- Natural gas-XNGUSD

- Oats

- Palm Oil

- Petrocurrency

- Propane

- Purified Terephthalic Acid (PTA)

- Random Length Lumber

- Rapeseed

- Rough Rice

- Rubber

- Softwood Pulp

- Soy Meal

- Soybean (DCE)

- Soybean Meal

- Soybean Oil

- Soybean Oil (DCE)

- Soybeans

- Sugar No.11

- Sugar No.14

- Tin

- West Texas Intermediate WTI

- Wheat (CBOT)

- Wheat (EURONEXT)

- XAGAUD-Silver vs Australian Dollar

- XAGEUR-Silver Vs Euro

- XAGGBP-Silver vs Great Britain Pound

- XAUAUD-Gold vs Australian Dollar

- XAUCHF-Gold Vs Swiss Franc

- XAUEUR-Gold Vs Euro

- XAUGBP-Gold vs Great Britain Pound

- XAUJPY-Gold vs Japanese Yen

- XNGUSD-Natural Gas vs US Dollar

- XPDUSD-Palladium Vs US Dollar

- XPTUSD-Platinum vs US Dollar

- Zinc

Fundamental Summary

- Coming soon!!