-

COUNTRIES:

-

PAIRS THAT CORRELATE:

-

2022 HIGHS & LOWS:

-

PAIR TYPE:

-

DAILY AVERAGE MOVEMENT IN PIPS:

ONE-YEAR CHART:

EUR ADDITIONAL INFO

-

COUNTRY:

-

CENTRAL BANK:

-

NICKNAME:

-

%OF AVERAGE DAILY TURNOVER:

USDADDITIONAL INFO

-

COUNTRY:

-

CENTRAL BANK:

-

NICKNAME:

-

%OF AVERAGE DAILY TURNOVER:

Table of Content

- Introduction

- What is XAUEUR?

- History of XAUEUR

- Uses of XAUEUR

- Advantages of XAUEUR

- Disadvantages of XAUEUR

- Conclusion

Introduction

XAUEUR is a term used to describe the price relationship between gold (XAU) and the Euro (EUR). It is a commonly traded forex pair that is used by investors to hedge against inflation or currency risk.

What is XAUEUR?

XAUEUR is a forex symbol that represents the value of one ounce of gold (XAU) measured in Euros (EUR). The exchange rate shows how much one currency is worth relative to the other. In the case of XAUEUR, it indicates how many Euros are needed to buy an ounce of gold.

History of XAUEUR

The XAUEUR forex pair was introduced in 1999 after the creation of the Euro currency. Since then, it has become a popular trading pair for investors who want to speculate on the value of gold or the Euro. The exchange rate has seen significant fluctuations over time due to economic and geopolitical events.

Uses of XAUEUR

Investors use the XAUEUR forex pair for several reasons:

- To hedge against inflation or currency risk

- To speculate on the direction of gold prices

- To diversify their investment portfolio

Advantages of XAUEUR

There are several advantages of trading the XAUEUR forex pair:

- It is a highly liquid market, which means that there is always a buyer or seller available

- The exchange rate is influenced by global economic and political events, providing opportunities for investors to profit from market changes

- Gold is considered a safe haven asset, making it an attractive investment during times of uncertainty or volatility

Disadvantages of XAUEUR

There are also some disadvantages to trading the XAUEUR forex pair:

- It can be volatile, particularly during times of economic or political upheaval

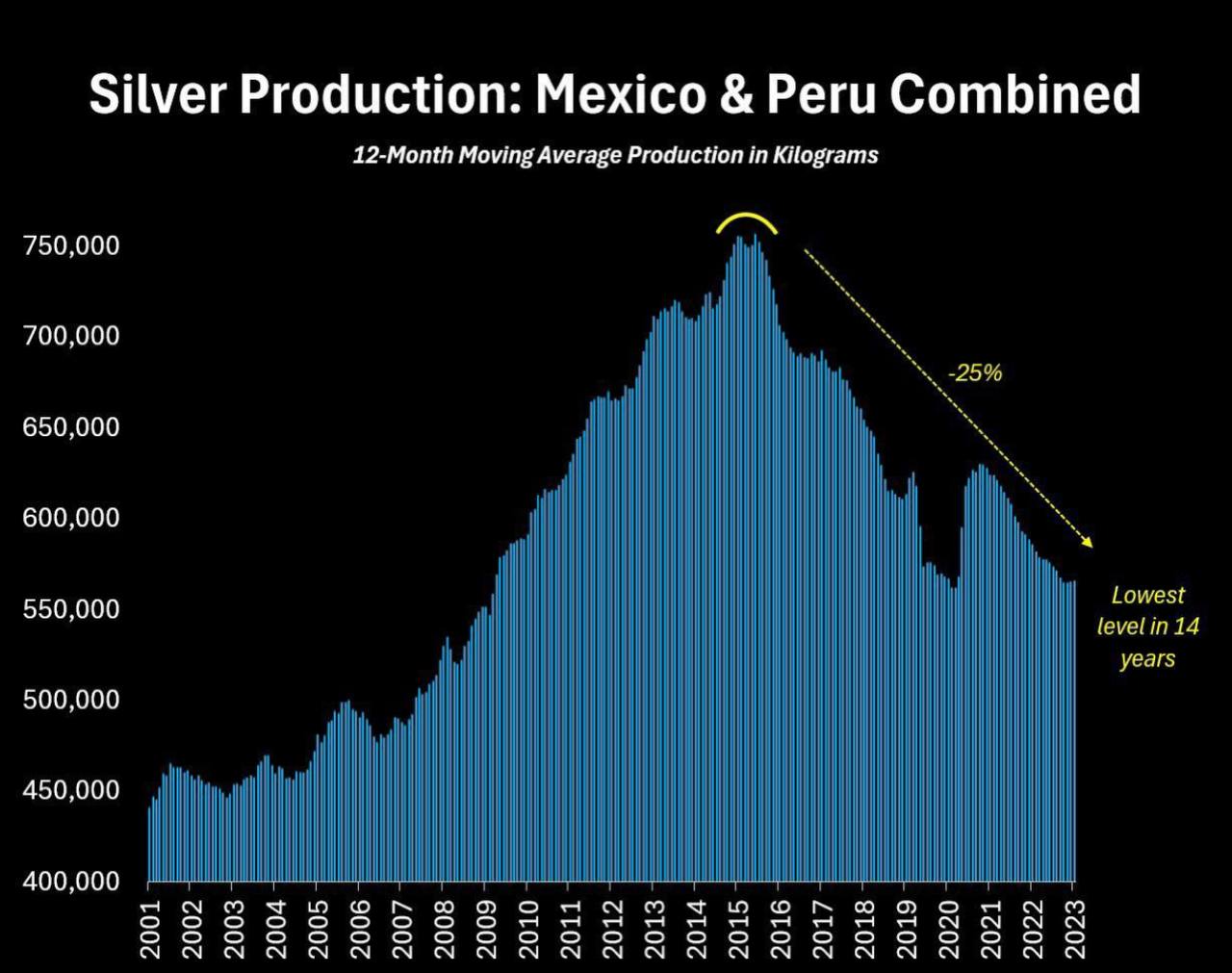

- The price of gold is influenced by factors such as supply and demand, which can be difficult to predict

- Forex trading involves significant risks, including the possibility of losing all invested capital

Conclusion

The XAUEUR forex pair is a popular trading instrument that allows investors to speculate on the value of gold or the Euro. It is influenced by global economic and political events, making it a volatile but potentially profitable investment. However, as with any investment, there are risks involved, and investors should carefully consider their investment goals and risk tolerance before trading XAUEUR.

Comodities

- XAUUSD-Gold Spot / U.S. Dollar

- Natural gas-XNGUSD

- WTI Crude Oil-US Cruide Oil-West Texas Intermediate Crude Oil or US Crude Oil

- XAGUSD--Silver / U.S. Dollar

- Brent Crude Oil-Brent_G3

- Crude Oil-XTIUSD

- XBRUSD-Brent Oil

- XBRUSD-Brent Oil vs US Dollar

- Adzuki bean

- CAC All-Tradable

- Cobalt

- Cocoa

- Coffee C

- Corn

- Corn (EURONEXT)

- Corn(DCE)

- Cotton No.2

- Crack Spread

- Crush Spread

- Feeder Cattle

- Frozen Concentrated Orange Juice

- Hardwood Pulp

- Heating Oil

- Lead

- Lean Hogs

- Live Cattle

- LME Copper

- LME Nickel

- Methods

- Milk

- Molybdenum

- Natural gas-XNGUSD

- Oats

- Palm Oil

- Petrocurrency

- Propane

- Purified Terephthalic Acid (PTA)

- Random Length Lumber

- Rapeseed

- Rough Rice

- Rubber

- Softwood Pulp

- Soy Meal

- Soybean (DCE)

- Soybean Meal

- Soybean Oil

- Soybean Oil (DCE)

- Soybeans

- Sugar No.11

- Sugar No.14

- Tin

- West Texas Intermediate WTI

- Wheat (CBOT)

- Wheat (EURONEXT)

- XAGAUD-Silver vs Australian Dollar

- XAGEUR-Silver Vs Euro

- XAGGBP-Silver vs Great Britain Pound

- XAUAUD-Gold vs Australian Dollar

- XAUCHF-Gold Vs Swiss Franc

- XAUEUR-Gold Vs Euro

- XAUGBP-Gold vs Great Britain Pound

- XAUJPY-Gold vs Japanese Yen

- XNGUSD-Natural Gas vs US Dollar

- XPDUSD-Palladium Vs US Dollar

- XPTUSD-Platinum vs US Dollar

- Zinc

Fundamental Summary

- Coming soon!!