-

COUNTRIES:

-

PAIRS THAT CORRELATE:

-

2022 HIGHS & LOWS:

-

PAIR TYPE:

-

DAILY AVERAGE MOVEMENT IN PIPS:

ONE-YEAR CHART:

Table of Contents

Introduction

Investing in a portfolio that includes various assets can be beneficial in reducing risks and maximizing returns. XAUGBP is a combination of two such assets – gold and the Great British Pound (GBP). In this article, we will look at what XAUGBP is, why investing in gold and GBP can be advantageous, and how to invest in XAUGBP.

What is XAUGBP?

XAUGBP is the symbol used to represent the price of an ounce of gold in terms of GBP. It is calculated by dividing the market value of one ounce of gold by the exchange rate of GBP/USD.

Why invest in Gold?

Gold is considered a safe haven asset, meaning that it tends to retain its value or increase in times of economic uncertainty or market turmoil. As a result, investors often turn to gold as a hedge against inflation and a potential store of value during periods of currency devaluation. Additionally, gold has historically had a low correlation with other assets, making it a diversification tool for portfolios.

Why invest in GBP?

GBP is the currency of the United Kingdom and one of the most widely traded currencies in the world. It is also considered a reserve currency, meaning that it is held in significant quantities by governments and institutions as part of their foreign exchange reserves. The UK economy has a strong presence in sectors such as finance, technology, and healthcare, making it an attractive destination for foreign investment.

Investing in XAUGBP

Investors can gain exposure to XAUGBP through various financial instruments such as exchange-traded funds (ETFs), futures contracts, or options. ETFs are a popular choice as they offer a diversified portfolio of gold and GBP assets while allowing ease of trading on major stock exchanges. Futures contracts and options offer more flexibility in terms of customization but require a deeper understanding of derivatives markets.

Conclusion

XAUGBP offers investors the opportunity to invest in two assets with different risk and return profiles, providing diversification benefits to their portfolios. While investing in XAUGBP requires careful consideration of market conditions and investment objectives, it can be a useful tool in achieving long-term financial goals.

EUR ADDITIONAL INFO

-

COUNTRY:

-

CENTRAL BANK:

-

NICKNAME:

-

%OF AVERAGE DAILY TURNOVER:

USDADDITIONAL INFO

-

COUNTRY:

-

CENTRAL BANK:

-

NICKNAME:

-

%OF AVERAGE DAILY TURNOVER:

Comodities

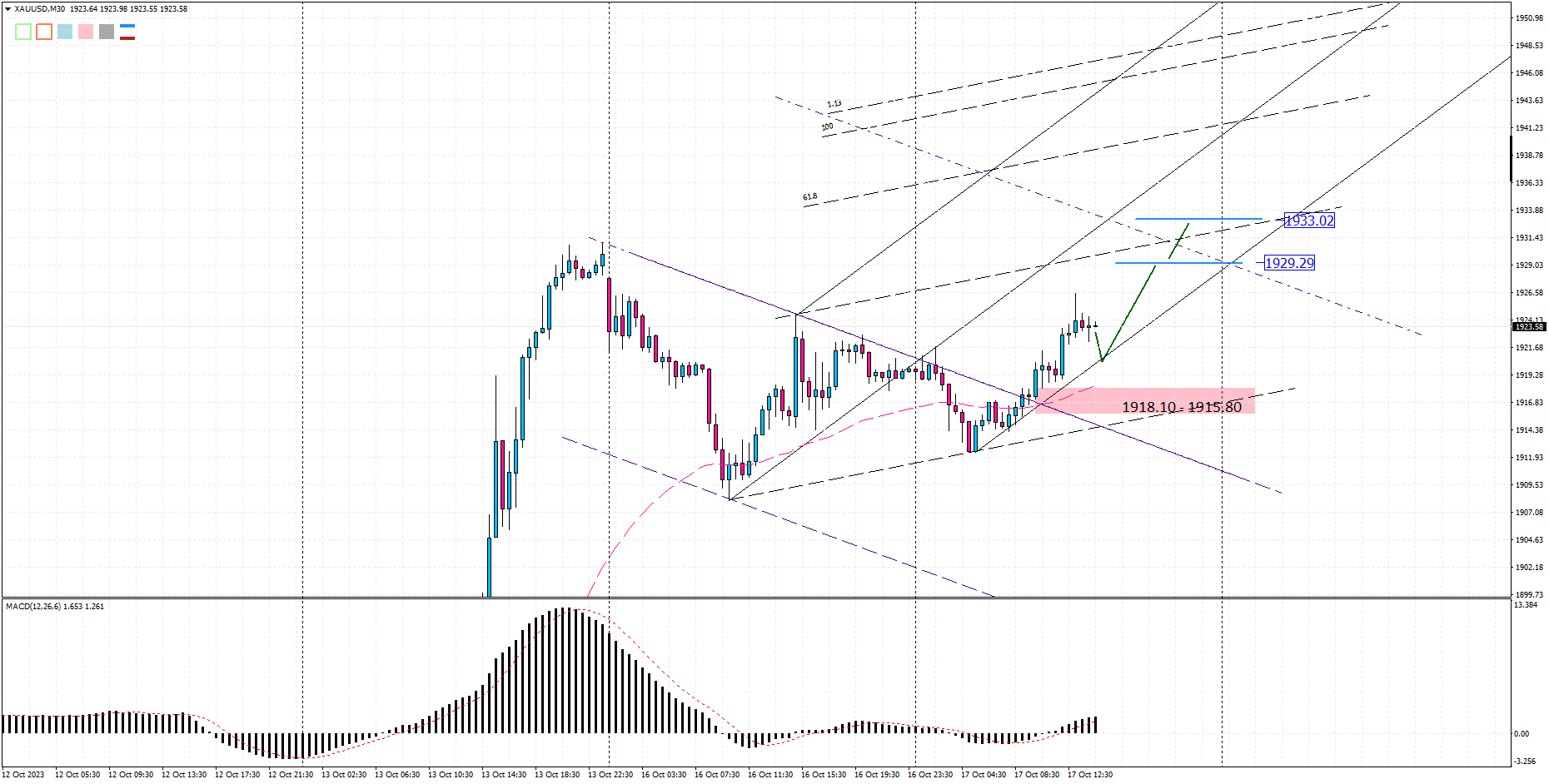

- XAUUSD-Gold Spot / U.S. Dollar

- Natural gas-XNGUSD

- WTI Crude Oil-US Cruide Oil-West Texas Intermediate Crude Oil or US Crude Oil

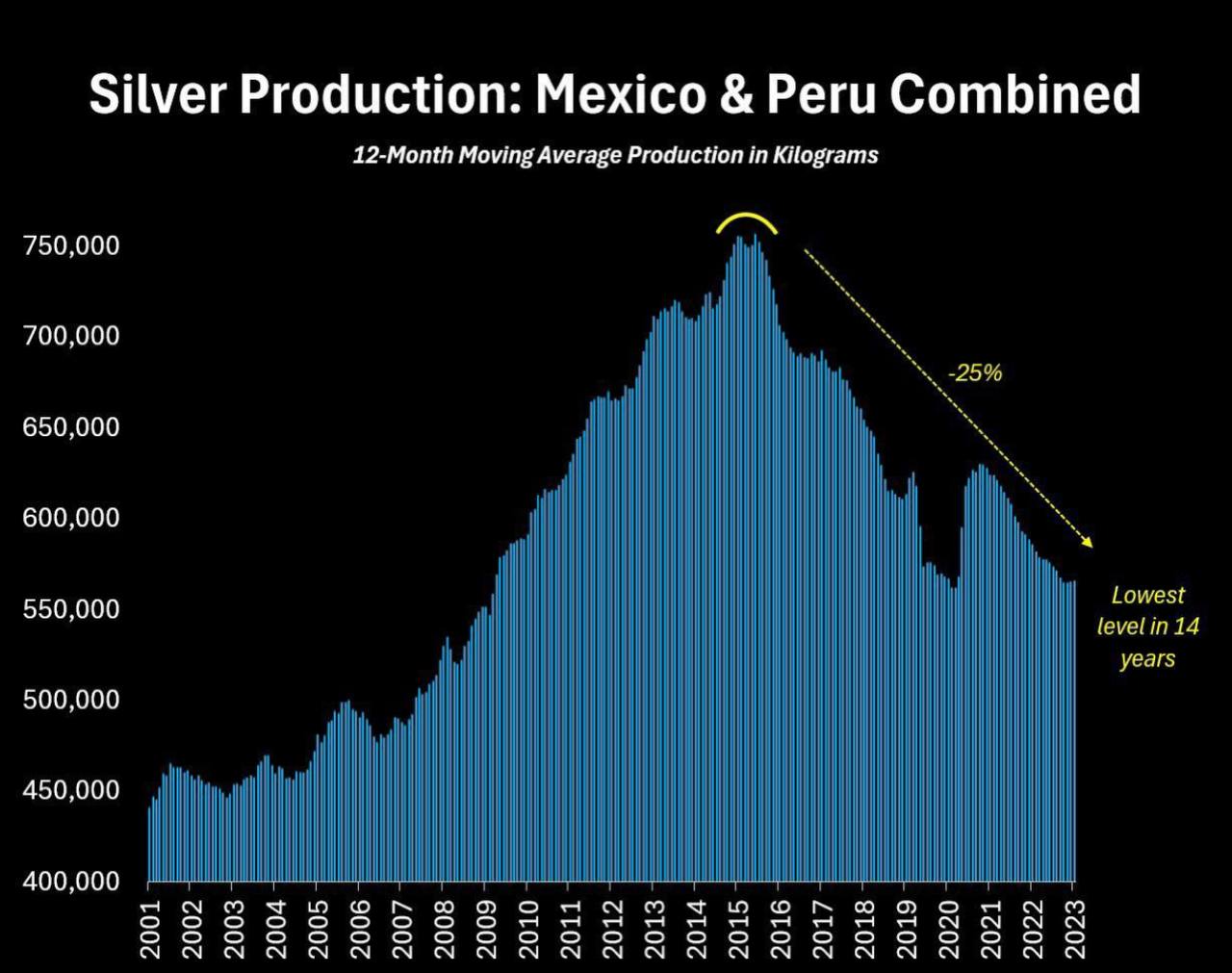

- XAGUSD--Silver / U.S. Dollar

- Brent Crude Oil-Brent_G3

- Crude Oil-XTIUSD

- XBRUSD-Brent Oil

- XBRUSD-Brent Oil vs US Dollar

- Adzuki bean

- CAC All-Tradable

- Cobalt

- Cocoa

- Coffee C

- Corn

- Corn (EURONEXT)

- Corn(DCE)

- Cotton No.2

- Crack Spread

- Crush Spread

- Feeder Cattle

- Frozen Concentrated Orange Juice

- Hardwood Pulp

- Heating Oil

- Lead

- Lean Hogs

- Live Cattle

- LME Copper

- LME Nickel

- Methods

- Milk

- Molybdenum

- Natural gas-XNGUSD

- Oats

- Palm Oil

- Petrocurrency

- Propane

- Purified Terephthalic Acid (PTA)

- Random Length Lumber

- Rapeseed

- Rough Rice

- Rubber

- Softwood Pulp

- Soy Meal

- Soybean (DCE)

- Soybean Meal

- Soybean Oil

- Soybean Oil (DCE)

- Soybeans

- Sugar No.11

- Sugar No.14

- Tin

- West Texas Intermediate WTI

- Wheat (CBOT)

- Wheat (EURONEXT)

- XAGAUD-Silver vs Australian Dollar

- XAGEUR-Silver Vs Euro

- XAGGBP-Silver vs Great Britain Pound

- XAUAUD-Gold vs Australian Dollar

- XAUCHF-Gold Vs Swiss Franc

- XAUEUR-Gold Vs Euro

- XAUGBP-Gold vs Great Britain Pound

- XAUJPY-Gold vs Japanese Yen

- XNGUSD-Natural Gas vs US Dollar

- XPDUSD-Palladium Vs US Dollar

- XPTUSD-Platinum vs US Dollar

- Zinc

Fundamental Summary

- Coming soon!!