-

COUNTRIES:

-

PAIRS THAT CORRELATE:

-

2022 HIGHS & LOWS:

-

PAIR TYPE:

-

DAILY AVERAGE MOVEMENT IN PIPS:

ONE-YEAR CHART:

Table of Contents:

- Introduction

- History of XAUJPY

- Factors Affecting XAUJPY

- Technical Analysis of XAUJPY

- Trading XAUJPY

- Conclusion

Introduction:

XAUJPY refers to the exchange rate between gold, measured in troy ounces, and the Japanese yen. It is a popular currency pair among traders due to its volatility and potential for profitability.

History of XAUJPY:

The history of XAUJPY dates back to the establishment of the Bretton Woods system in 1944, which fixed the exchange rate of currencies to the US dollar. After the collapse of the system in 1971, the value of currencies became floating, leading to the creation of currency pairs such as XAUJPY.

Factors Affecting XAUJPY:

- Global economic conditions

- Political developments

- Monetary policy decisions

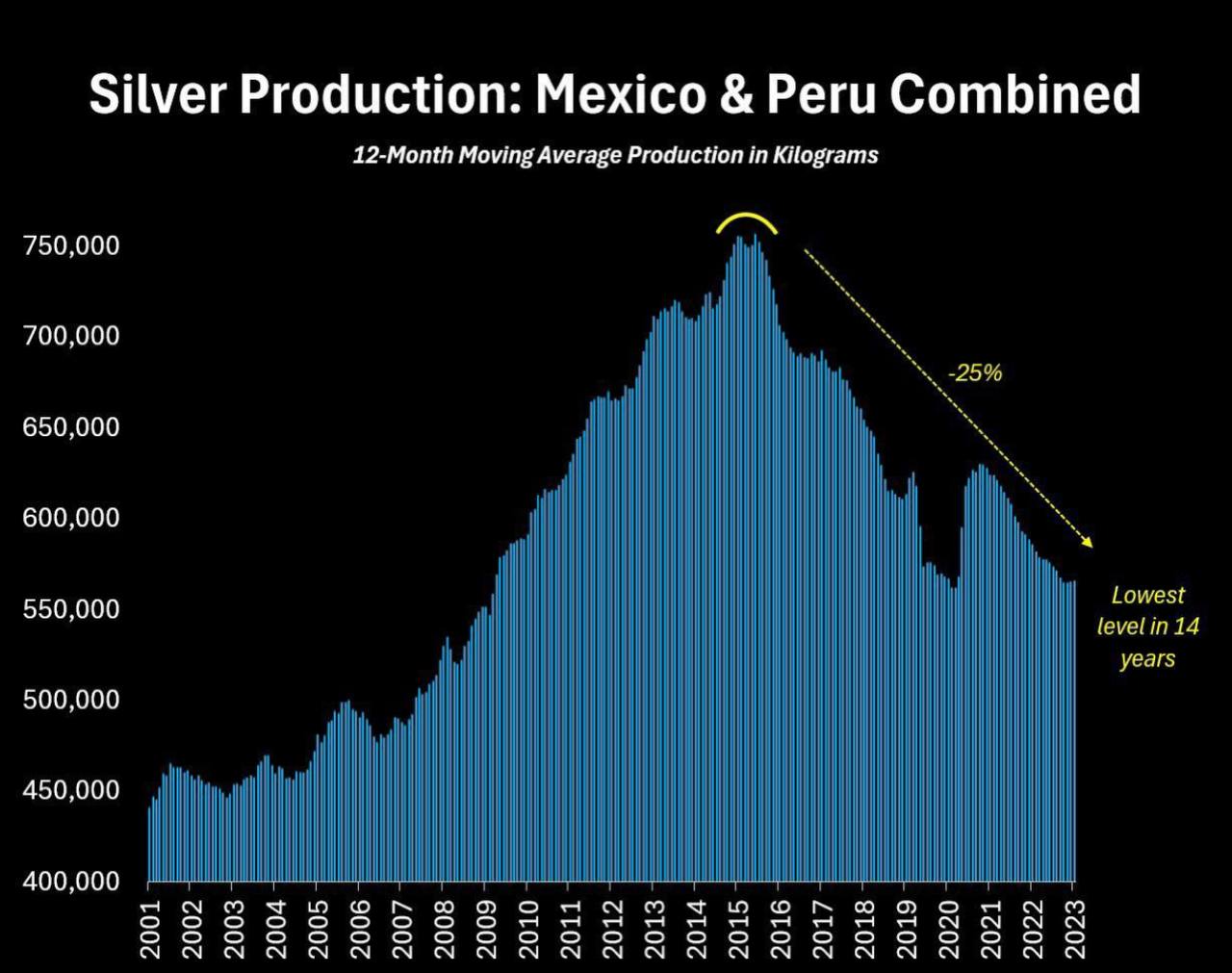

- Demand and supply factors affecting gold prices

- Exchange rate movements of other major currencies like USD, EUR, GBP, etc.

Technical Analysis of XAUJPY:

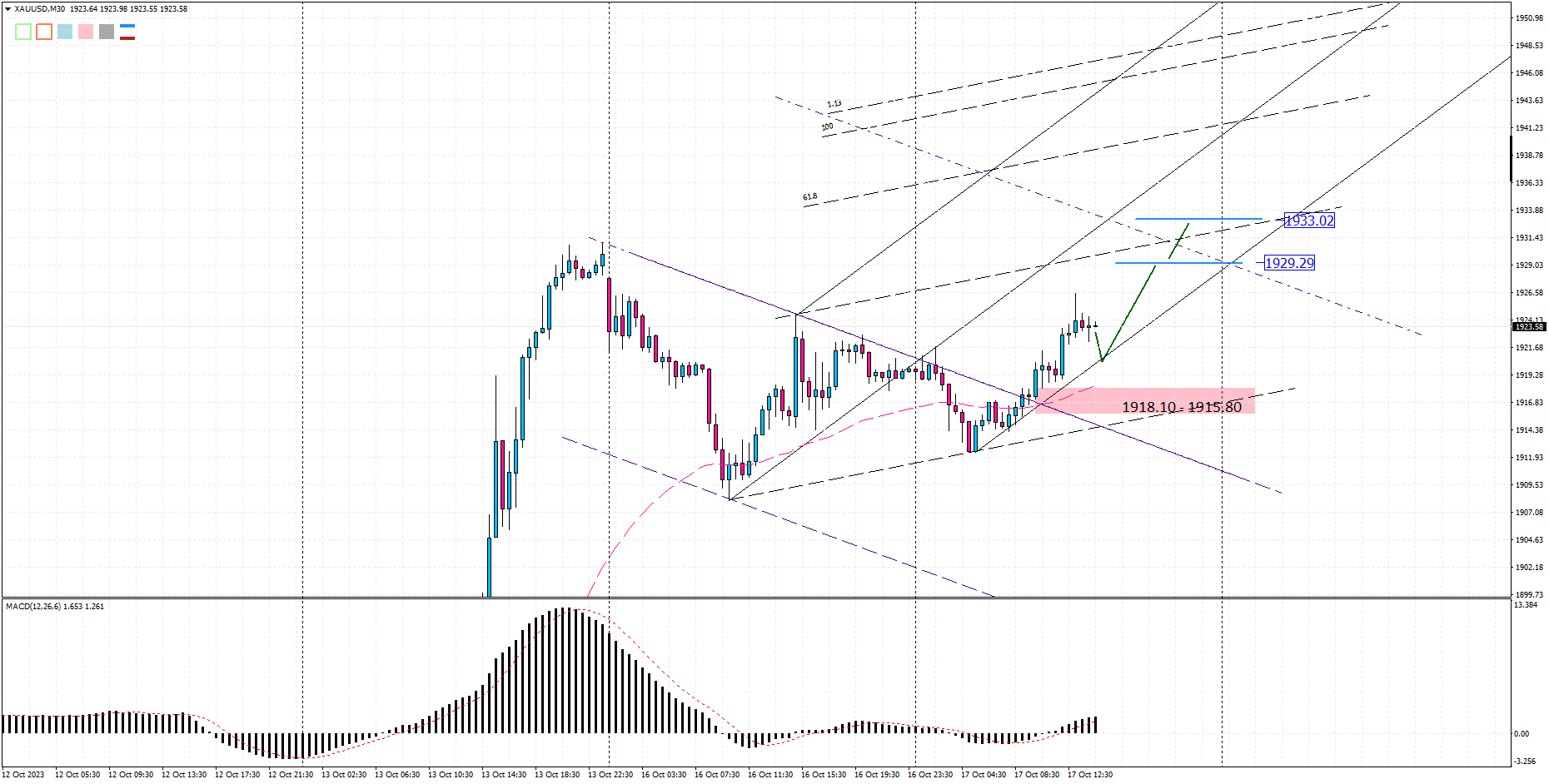

Technical analysis involves studying historical price movements and chart patterns to predict future price movements. Some popular indicators used for technical analysis of XAUJPY include:

- Relative Strength Index (RSI)

- Moving Average Convergence Divergence (MACD)

- Bollinger Bands

- Fibonacci retracements

- Pivot points

Trading XAUJPY:

Trading XAUJPY involves buying or selling the currency pair based on market trends and analysis. Some popular trading strategies used for XAUJPY include:

- Swing trading

- Position trading

- Momentum trading

- Scalping

- News trading

Conclusion:

XAUJPY is a volatile currency pair that can offer significant profit opportunities for traders who understand the factors affecting its movement and use effective trading strategies. It is important to conduct thorough analysis and risk management before trading XAUJPY.

EUR ADDITIONAL INFO

-

COUNTRY:

-

CENTRAL BANK:

-

NICKNAME:

-

%OF AVERAGE DAILY TURNOVER:

USDADDITIONAL INFO

-

COUNTRY:

-

CENTRAL BANK:

-

NICKNAME:

-

%OF AVERAGE DAILY TURNOVER:

Comodities

- XAUUSD-Gold Spot / U.S. Dollar

- Natural gas-XNGUSD

- WTI Crude Oil-US Cruide Oil-West Texas Intermediate Crude Oil or US Crude Oil

- XAGUSD--Silver / U.S. Dollar

- Brent Crude Oil-Brent_G3

- Crude Oil-XTIUSD

- XBRUSD-Brent Oil

- XBRUSD-Brent Oil vs US Dollar

- Adzuki bean

- CAC All-Tradable

- Cobalt

- Cocoa

- Coffee C

- Corn

- Corn (EURONEXT)

- Corn(DCE)

- Cotton No.2

- Crack Spread

- Crush Spread

- Feeder Cattle

- Frozen Concentrated Orange Juice

- Hardwood Pulp

- Heating Oil

- Lead

- Lean Hogs

- Live Cattle

- LME Copper

- LME Nickel

- Methods

- Milk

- Molybdenum

- Natural gas-XNGUSD

- Oats

- Palm Oil

- Petrocurrency

- Propane

- Purified Terephthalic Acid (PTA)

- Random Length Lumber

- Rapeseed

- Rough Rice

- Rubber

- Softwood Pulp

- Soy Meal

- Soybean (DCE)

- Soybean Meal

- Soybean Oil

- Soybean Oil (DCE)

- Soybeans

- Sugar No.11

- Sugar No.14

- Tin

- West Texas Intermediate WTI

- Wheat (CBOT)

- Wheat (EURONEXT)

- XAGAUD-Silver vs Australian Dollar

- XAGEUR-Silver Vs Euro

- XAGGBP-Silver vs Great Britain Pound

- XAUAUD-Gold vs Australian Dollar

- XAUCHF-Gold Vs Swiss Franc

- XAUEUR-Gold Vs Euro

- XAUGBP-Gold vs Great Britain Pound

- XAUJPY-Gold vs Japanese Yen

- XNGUSD-Natural Gas vs US Dollar

- XPDUSD-Palladium Vs US Dollar

- XPTUSD-Platinum vs US Dollar

- Zinc

Fundamental Summary

- Coming soon!!