Two Dow Jones indices

Dow Jones Industrial Average Index: A Brief Overview

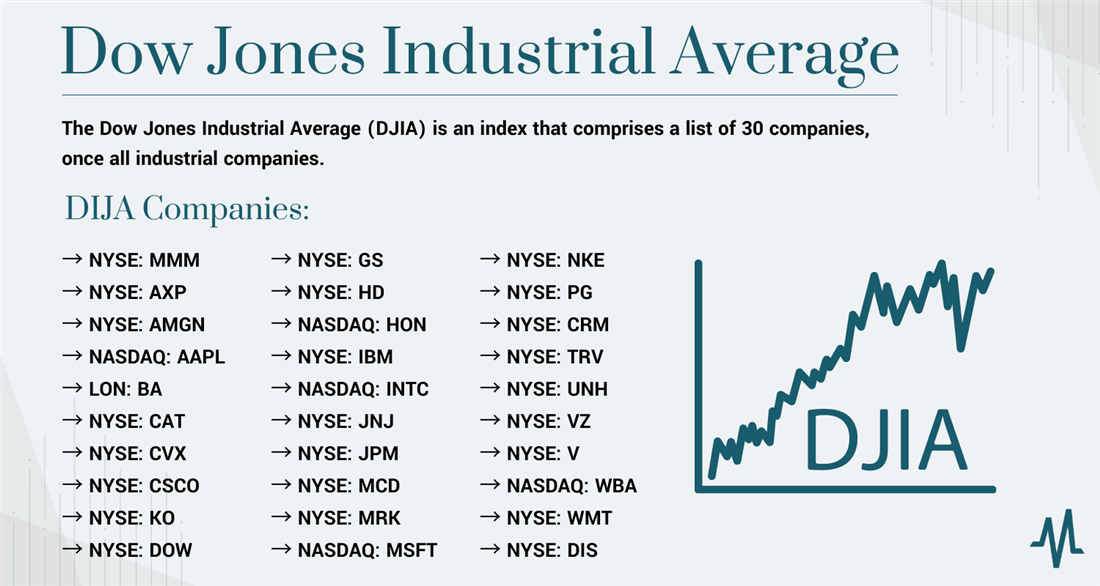

The Dow Jones Industrial Average (DJIA), often referred to as the Dow, is one of the most widely recognized stock market indices in the world. It represents a selected group of 30 large publicly traded companies based in the United States, which are considered leaders in their respective industries.

Originally created by Charles Dow in 1896, the DJIA was designed to provide investors with a snapshot of the overall health and performance of the U.S. stock market. Over the years, it has become an essential benchmark for measuring the strength and direction of the American economy.

Components of the Dow Jones Industrial Average Index

The 30 companies included in the DJIA are carefully chosen by the editors of The Wall Street Journal, who seek to represent a diverse range of industries while maintaining the index’s integrity. Some of the major sectors represented in the index include technology, finance, healthcare, and consumer goods.

Notable companies currently listed on the DJIA include Apple Inc., Microsoft Corporation, Johnson & Johnson, Visa Inc., and The Coca-Cola Company, among others. These companies are known for their strong market presence, financial stability, and overall impact on the U.S. economy.

Calculation and Weighting

The DJIA is a price-weighted index, which means that the component stocks are weighted based on their share prices rather than their market capitalization. This method gives higher-priced stocks more influence on the index’s movements compared to lower-priced ones. To calculate the DJIA, the sum of the share prices of all 30 components is divided by a divisor that adjusts for stock splits, dividends, and other corporate actions.

Other Dow Jones Indices

In addition to the DJIA, the Dow Jones & Company also calculates and maintains several other indices that focus on different aspects of the stock market. These include:

- Dow Jones Transportation Average (DJTA): Comprised of 20 transportation companies, this index measures the performance of the transportation sector and is often seen as an indicator of broader economic trends.

- Dow Jones Utility Average (DJUA): Consisting of 15 utility stocks, this index reflects the performance of the utility industry and is closely watched by investors seeking stability and dividends.

These additional indices provide investors with more specific insights into various sectors and industries, allowing for a deeper understanding of the overall market conditions.

Conclusion

The Dow Jones Industrial Average Index serves as a crucial barometer of the U.S. stock market and the broader economy. With its diverse group of 30 blue-chip companies, it provides investors with a snapshot of the market’s performance and direction. Additionally, the Dow Jones & Company’s other indices, such as the Dow Jones Transportation Average and Dow Jones Utility Average, offer further insight into specific sectors, helping investors make informed decisions.

Whether you are a seasoned investor or someone starting their journey in the world of finance, keeping an eye on the Dow Jones indices can provide you with valuable information and assist you in navigating the complex world of investing.