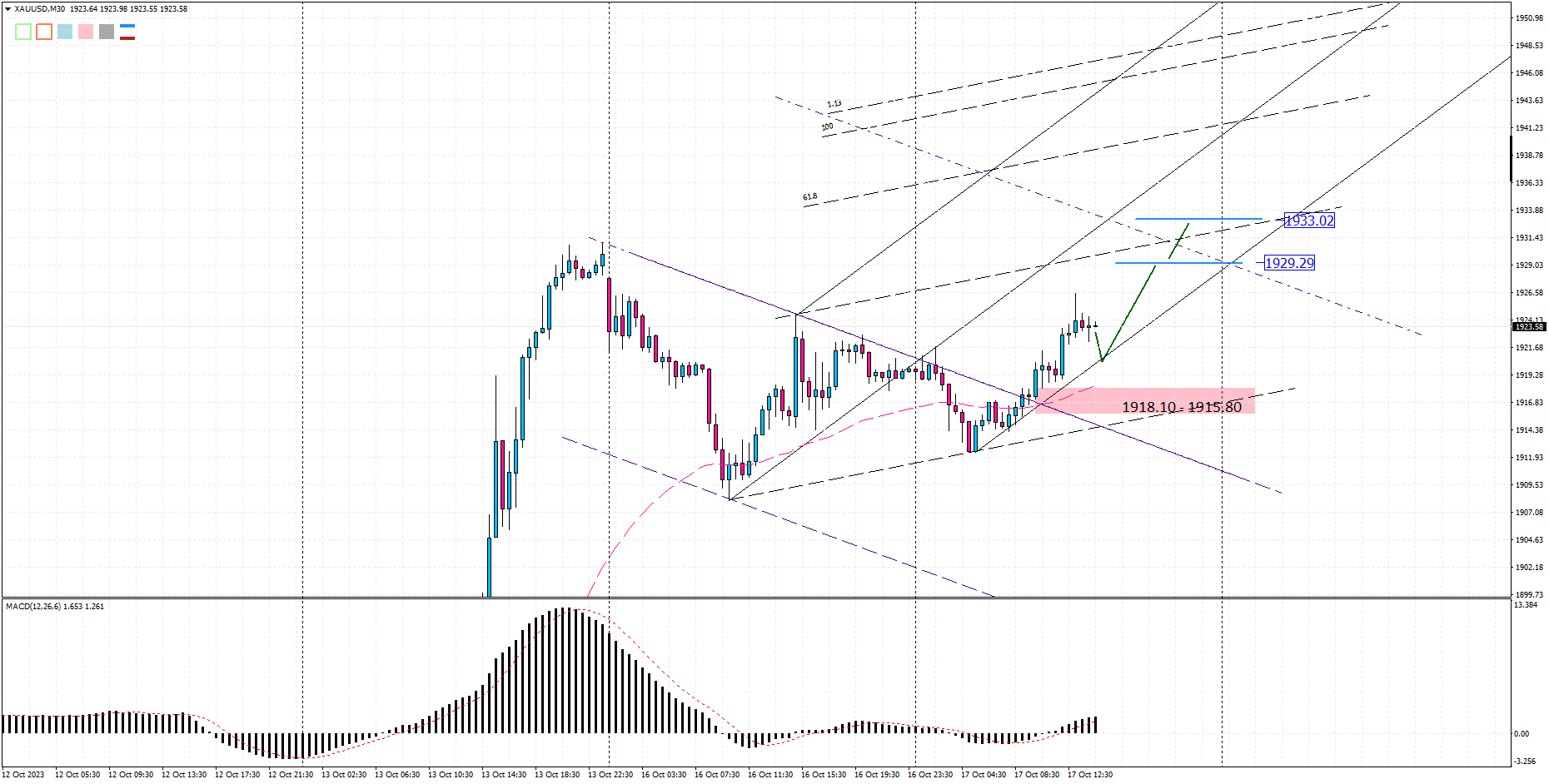

XAUUSD

, 30 minutes

long

long

#Market Sentimental

#Bullish

| Resistance 1 | 1929 |

|---|---|

| Quote Price | 1923 |

| Support 1 | 1918 |

| Support 2 | 1915 |

After trading in the negative range in the Asian market, the price of gold returned to the rise at the beginning of the London market and remained above the level of 1920 dollars in the mid-day time.

Market activists are closely monitoring the events in the Middle East.

Meanwhile, the US dollar index fell to 106.28 after retreating from last week’s high of 106.78. US Treasury yields rose to 4.71% as the 10-year Treasury yield rose. While the 2-year YS remains at 5.10%.

Many Federal Reserve (Fed) officials, including Chicago Fed President Austin Goolsby and Philadelphia Fed President Patrick Harker, maintained their dovish stances. Harker said on Monday that the Fed should keep interest rates steady if the data is unchanged. However, an upbeat US inflation report and higher inflation expectations data last week prompted investors to price in a possible rate hike by the Federal Reserve (Fed). This, in turn, may push the US dollar (USD) higher and affect gold prices.

The Federal Reserve Bank of New York reported on Monday that the New York state manufacturing index fell to 4.6 in October from a previous increase of 1.9, beating expectations for a 7.0 decline. Last week, the US Consumer Price Index (CPI) for September was 3.7% and 0.4%, respectively, on an annual and monthly basis. Both numbers exceeded market expectations.

Apart from this, key economic data from China on Wednesday could give a clearer direction to gold prices. China’s gross domestic product (GDP) for the third quarter, industrial production and retail sales will be released on Wednesday. A weaker-than-expected reading could lower gold prices as China is the world’s largest producer and consumer of gold.

On the other hand, the escalation of geopolitical tensions between Israel and Hamas could increase the demand for a traditional safe-haven asset like gold. Earlier on Tuesday, the US Marine Corps Rapid Response Force headed for the waters off Israel’s coast. A rapid reaction force of 2,000 Marines and sailors is being deployed. According to CNN, the country will join the growing number of US warships en route to Israel to send a deterrent message to Iran and the Lebanese Hezbollah militant group.

Gold traders will monitor US retail sales due on Tuesday. This figure is expected to increase by 0.2 percent. On Wednesday, China’s GDP for the third quarter ends. Annual growth is estimated at 4.4% while the monthly figure is expected to increase by 1.0%. Traders take cues from these events and find trading opportunities around the price of gold.

Gold technical outlook:

In the thirty-minute time frame, the probability of the continuation of the upward trend has increased under a series of other upward movements. As long as the level of 1918.10 – 1915.80 dollars is preserved, we expect the continuation of growth to the next levels of 1929.29 and 1933 dollars.

Leave a Reply

You must be logged in to post a comment.